CHOOSE 1ST FOR WOMEN

CHOOSE 1ST FOR WOMEN

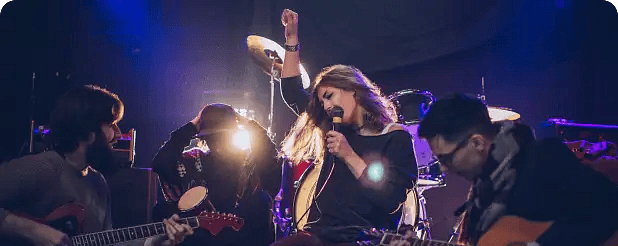

EVENTS LIABILITY

INSURANCE

![]() Peace of mind for your events

Peace of mind for your events![]() Get up to R100million in cover

Get up to R100million in cover ![]() Once off cover for single events

Once off cover for single events

![]() Peace of mind for your events

Peace of mind for your events![]() Get up to R100million in cover

Get up to R100million in cover![]() Once off cover for single events

Once off cover for single events

Stay road-ready with Tyre & Rim cover

1st for Women Insurance Events Liability cover is tailored for you. Empowering Event Managers, Organisers, Exhibitors, and Sponsors. Protect against legal liabilities for third party property damage and third party bodily injury at your event. Safeguard your business with confidence.

We know the roads can be rough on your tyres, rims, and wallet too. That’s why we’ve got your back with our Tyre & Rim Cover. With us, you can confidently get back on the road knowing we’ll handle any accidental damage from those pesky potholes and uneven roads.

Events Covered by Events Liability Insurance

An event encompasses gatherings with potential risks to people or property, like public gatherings, festivals, or sports events. Safety is your priority as organisers, which includes having the right insurance coverage in place.

We Offer Two types of Event Liability Insurance Policies

Some policies may exclude certain high-risk activities or specific types of events. Review your Budget Insurance policy exclusions, as coverage limitations can vary.

Businesses covered by Event Liability

An event encompasses gatherings or activities that may pose risks to individuals or property. This includes public gatherings, festivals, sports events, or any organised function where damage or injury could occur.

1st for Women provides cover for several types of businesses such as:

We offer a minimum limit of R1 million and a maximum limit of R100 million.

Common extensions include

We also offer a variety of extensions you may wish to add to your Event Liability policy. R500 000 cover automatically included and can be increased for an additional premium.

Damage to Leased Property

We offer coverage for damage to leased property, ensuring you're protected if an accident or incident causes damage to the premises you lease, giving you peace of mind during your operations.

Damage to Rented Property

Our insurance includes protection for rented property, covering you in the event of accidental damage to property rented for your business use, so you're not left with the financial burden.

Collapse of Temporary Structures

We provide coverage for the collapse of temporary structures, protecting your business in case of unforeseen circumstances that may cause damage to any temporary setups or event spaces.

Emergency Medical Expenses

Our plan includes emergency medical expense coverage, helping to cover the costs of medical care in case of injuries that occur during your events, protecting both your business and your guests.

Wrongful Arrest and Defamation

Our insurance extends to cover wrongful arrest and defamation claims, ensuring you're protected against legal action resulting from accusations of wrongful conduct or defamatory statements.

Statutory Defence Costs

We offer coverage for legal costs incurred in defending your business against regulatory or statutory claims, ensuring you’re protected from the burden of legal fees and safeguarding your operations.

Other essential Business Insurance solutions for women

Frequently asked questions

What is Event Liability Insurance in South Africa?

How much does Event Liability Insurance cost?

What types of events are covered by Liability Insurance

Get a quick quote for

Events Liability Cover!

1st for Women is a licensed non-life Insurer and Financial Services Provider. Terms and Conditions online.